MIKE LOFTIN

Chief Executive Officer

DAVID DELGADO

Chair, Board of Directors

Learn about Dave’s family roots in Santa Fe and why he believes in the Homewise mission

When we chose this year’s annual report theme, ‘Strength in Numbers’, we had no idea how important that concept would become throughout the year.

With the COVID-19 pandemic, we’ve all had to change the way we approach just about everything we do. This is true in the way we live, work, interact, and take care of ourselves and each other. Here at Homewise, our approach to continuing to deliver our programs and services has changed dramatically over these past months.

Many of our services have traditionally relied on in-person activities such as financial coaching and workshops with our Home Purchase Advisors and Coaches, home showings and tours with our Realtors, loan meetings and closings with our Loan Officers, and community-based arts and culture events with our Community Development team. Our staff quickly pivoted to finding new and innovative ways to work in partnership with our clients and community to provide all of these services, without interruption, through virtual formats. We also took quick action to establish the Emergency Mortgage Assistance fund, providing support to those most financially vulnerable in the COVID-19 crisis to ensure they can continue to make their mortgage payments and keep their homes. Our staff has recently grown to 100 strong, and it is through our own Strength in Numbers that we pulled together to stay focused on our mission during these uncertain and uneasy times.

We know that we are only successful when our clients and communities are successful, and it is with this motivation that we operate as a team to support our clients and communities on the path to financial wellbeing and improved quality of life. For every client who achieves their dream of homeownership, there is a Homewise team behind them, supporting them every step of the way. From our financial coaches to our Realtors to our homebuilders to our lenders, we serve as a trusted guide, encouraging and empowering clients to reach their goals. In our communities, we serve as collaborative partners in sustainable, community-led redevelopment with a cultural preservation heart.

We invite you to read more about our work, and meet some of the people who have experienced its transformative impact, in the pages of this year’s annual report. During these difficult times, we remain deeply committed to serving individuals, families and communities across New Mexico and continuing to deliver on the promise of our mission. Thank you for supporting Homewise.

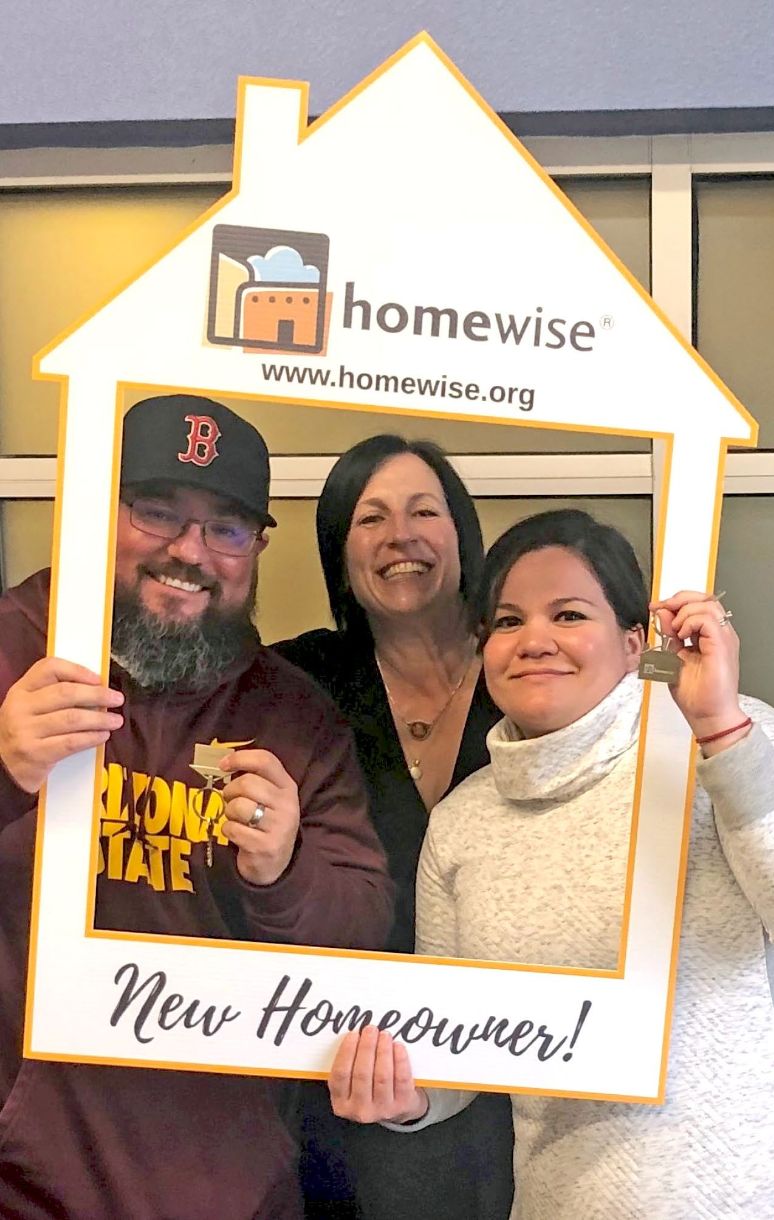

...there's a Homewise team who helped them through each step of the home buying process

- Karla & Gabriel

read their full story"We couldn’t have picked a better team. They were so respectful and professional. We were blessed to have Homewise."

How we impact our communities

Class attendees

who learned to proactively manage their money and become confident homebuyers

New homeowners

who are increasing their financial wellbeing and strengthening their neighborhoods

Refinance and home improvement loans

that help clients lower their monthly mortgage payments and invest in their homes with energy-efficient upgrades

New Homewise Homes

to provide much-needed affordable, high-quality homes in Santa Fe

How we improve our clients' financial wellbeing

We help them increase their credit score

77 points

We help them increase their savings

$4,000

We help them decrease their monthly debt

$127

Who are our clients?

by household

by age group

by employer

a dream

come true

Andrea's story

a dream

come true

Andrea's story

Despite her success as a private chef and caterer, Andrea found she could not afford to buy a home in her native Santa Fe. She felt fortunate to be living in a casita owned by her parents, but yearned for a place she could truly call her own. Then she discovered Homewise.

Andrea learned that with the right resources, homeownership is possible. Watch her inspiring story.

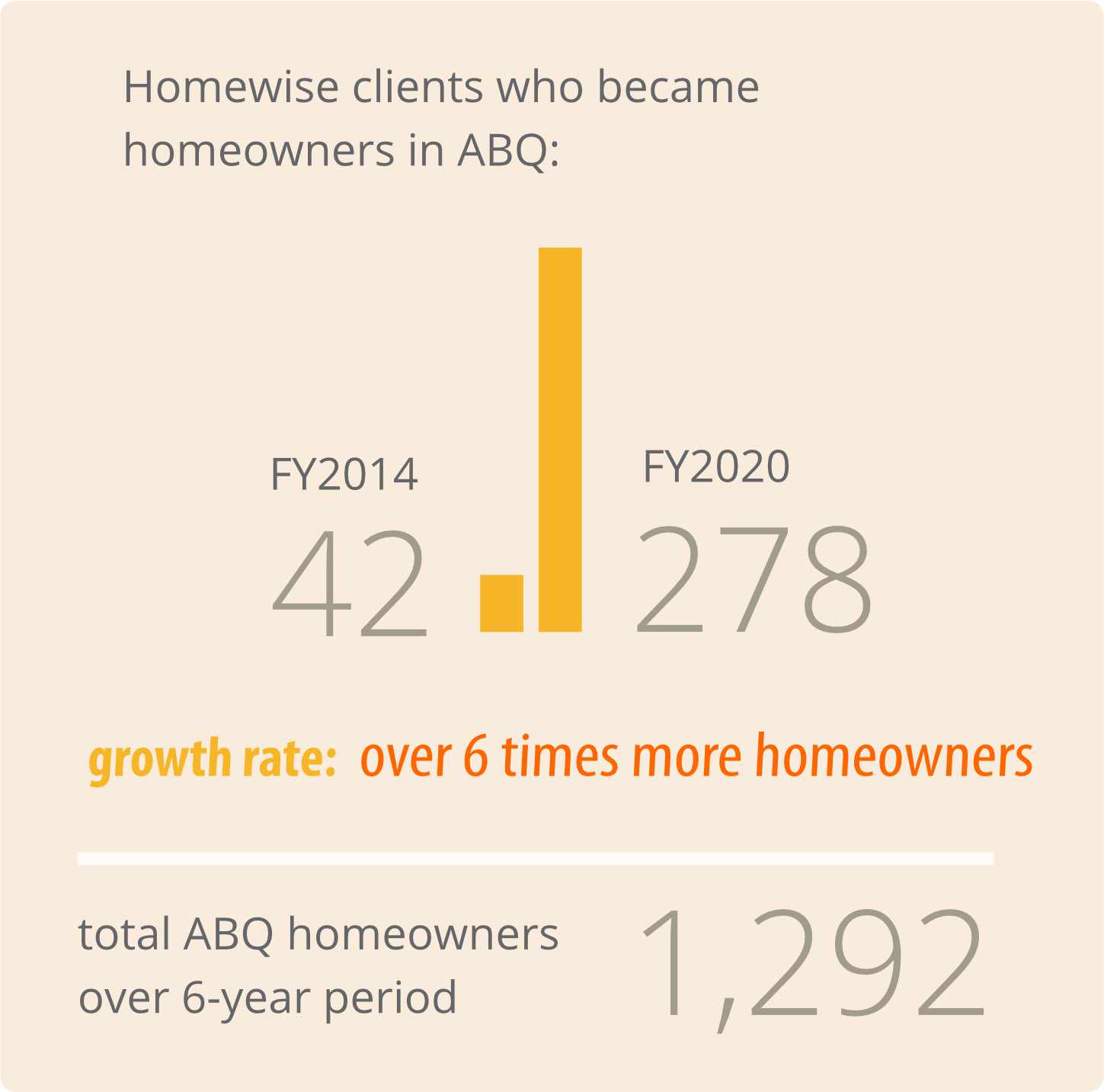

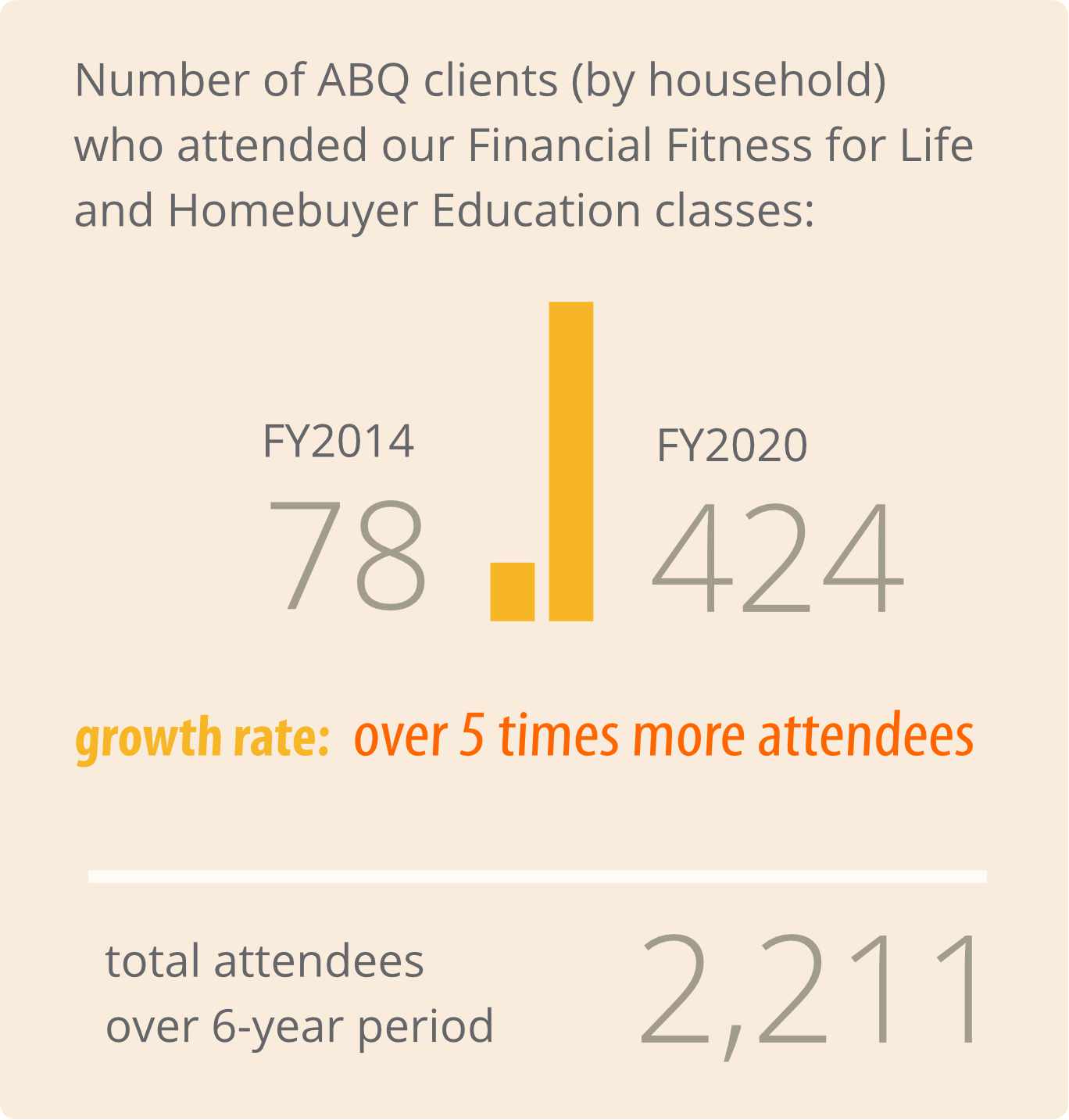

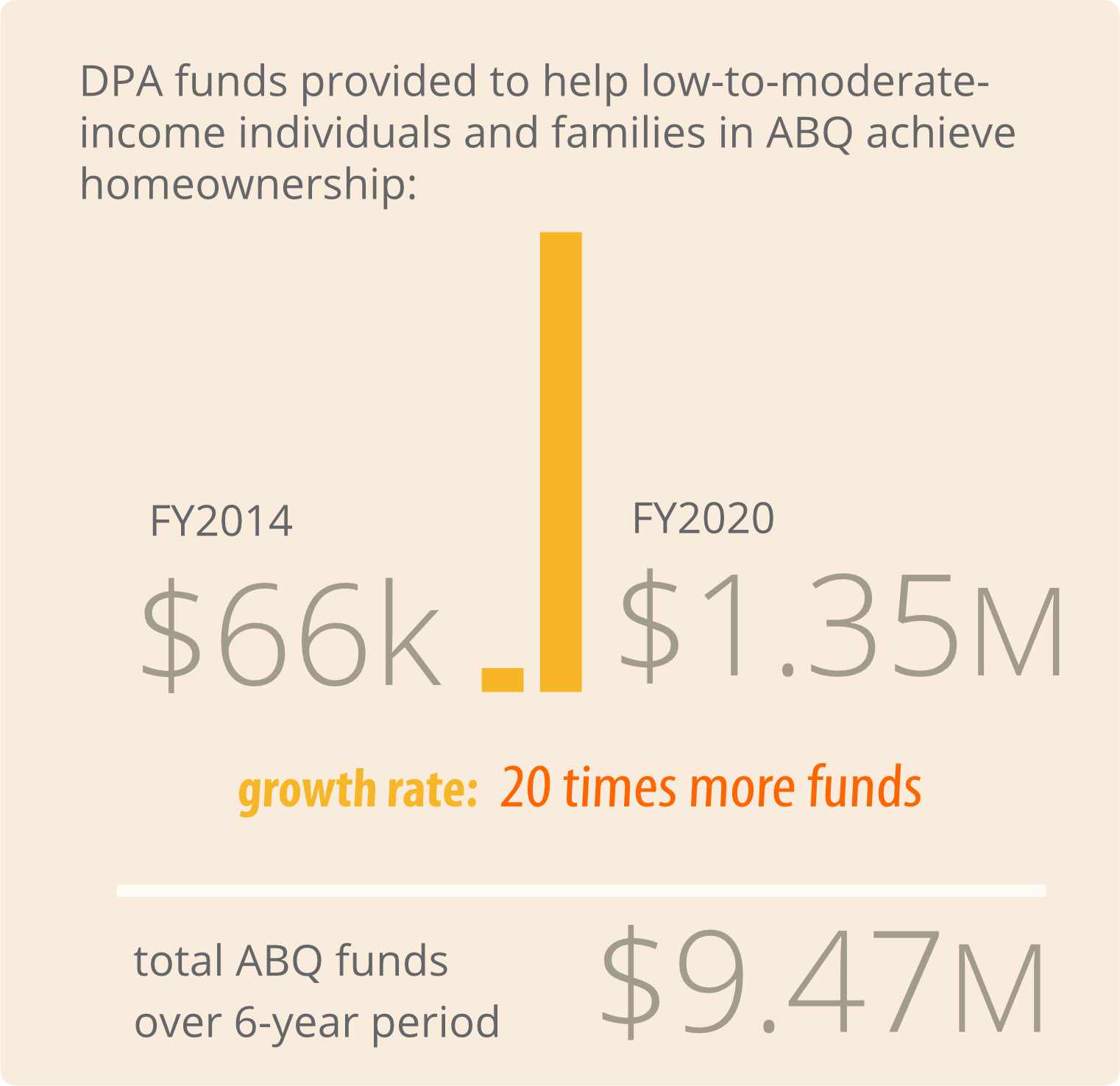

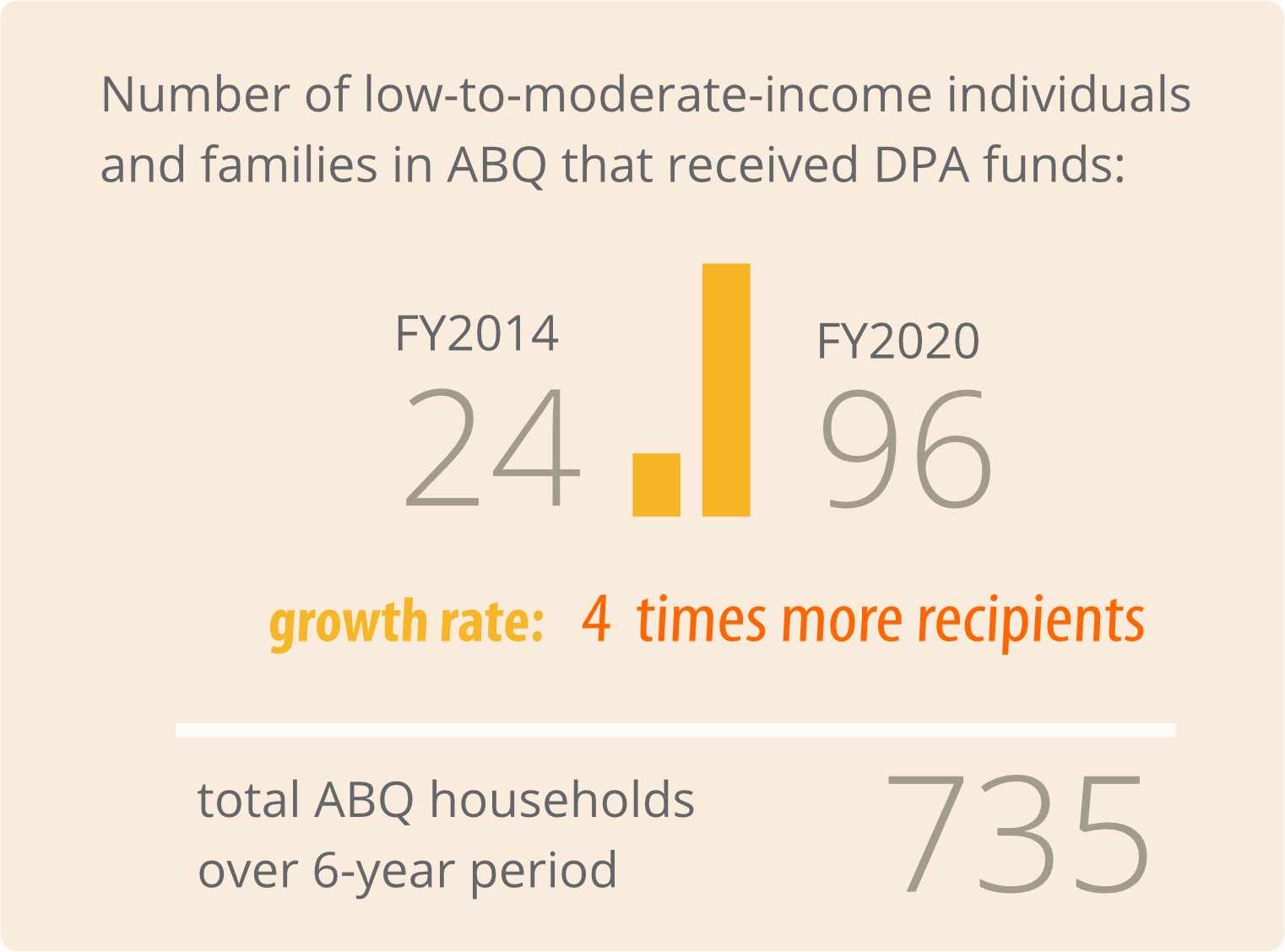

making a difference in Albuquerque

In 2012, Homewise opened a second location in Albuquerque, NM and expanded our programs and services in that area of the state. What started with only two employees working out of a small office on Lomas Boulevard has now grown to a team of over two dozen employees working at our Albuquerque Homeownership headquarters at the Orpheum Community Hub. “We are all actively engaged in helping clients become successful homeowners,” says Elena Gonzales, Senior Director, Policy & Community Engagement. “Everyone deserves the chance to build family wealth through homeownership.”

Homewise has also taken on a specific focus of serving the Barelas neighborhood, where the Orpheum Community Hub is located, by supporting the local arts community and renovating distressed residential and commercial properties to create energy-efficient, affordable homes and community spaces.

Great neighborhoods make a great city, and we seek to continue to work with our partners and neighbors for the benefit of the entire city.

homeowners

Elena Gonzales

Senior Director, Policy & Community Engagement

education

downpayment assistance (DPA)

a perfect fit

We’ve completed the second phase of our popular El Camino Crossing community: 13 one-bedroom condos. Quality built with energy-efficient features, the 705 s.f. condos are designed to be a perfect fit for those who are ready to downsize or prefer to live more simply and don’t want to be encumbered with a lot of maintenance and upkeep. The condo units are grouped into three buildings: a single-story with 3 units, and two 2-story with 5 units each. Two of the 2nd floor units feature a 500 s.f. rooftop deck.

El Camino Crossing is an all-solar, mixed-use community consisting of residential homes, condos, and live/work space in close proximity to local businesses that are neighborhood friendly. Located in the heart of Santa Fe within the newly revitalized Siler and Agua Fria corridors, El Camino Crossing also provides residents with easy access to walking and biking paths.

El Camino Crossing reflects so many of Santa Fe’s unique values and needs. It provides reasonably priced housing, revitalizes a neighborhood, supports local businesses, promotes creative entrepreneurship and values sustainability.- Mike Loftin, CEO

a perfect fit

We’ve completed the second phase of our popular El Camino Crossing community: 13 one-bedroom condos. Quality built with energy-efficient features, the 705 s.f. condos are designed to be a perfect fit for those who are ready to downsize or prefer to live more simply and don’t want to be encumbered with a lot of maintenance and upkeep. The condo units are grouped into three buildings: a single-story with 3 units, and two 2-story with 5 units each. Two of the 2nd floor units feature a 500 s.f. rooftop deck.

El Camino Crossing is an all-solar, mixed-use community consisting of residential homes, condos, and live/work space in close proximity to local businesses that are neighborhood friendly. Located in the heart of Santa Fe within the newly revitalized Siler and Agua Fria corridors, El Camino Crossing also provides residents with easy access to walking and biking paths.

empowering our healthcare workers

Homewise is proud to partner with local healthcare provider CHRISTUS St. Vincent and Anchorum St. Vincent in the creation of two special programs designed to help CHRISTUS employees enjoy greater financial stability and wellbeing.

Homeownership ProgramFor most people, purchasing a home is one of the most important financial investments they will make. By working with Homewise, CHRISTUS employees can receive downpayment assistance, save money through a special interest rate and low downpayment, and work with a dedicated housing navigator to find a home that will fit their lifestyle and budget.

Matched Savings ProgramA healthy savings goes a long way toward creating financial wellbeing. We encourage CHRISTUS employees to save more by providing up to $500 in matched savings rewards. The more they save, the more they are rewarded, helping to boost their balance, build a more robust savings, and develop a strong savings habit.

Want to learn more about creating a business partnership with Homewise? Contact Ken Brown, Outreach Manager, at 505.795.7581, or kbrown@homewise.org

CHRISTUS employee Melissa and her husband Caleb took advantage of our Homeownership Program and are now proud homeowners who are able to live in the same community where they work.

empowering our healthcare workers

CHRISTUS employee Melissa and her husband Caleb took advantage of our Homeownership Program and are now proud homeowners who are able to live in the same community where they work.

Homewise is proud to partner with local healthcare provider CHRISTUS St. Vincent and Anchorum St. Vincent in the creation of two special programs designed to help CHRISTUS employees enjoy greater financial stability and wellbeing.

Homeownership ProgramFor most people, purchasing a home is one of the most important financial investments they will make. By working with Homewise, CHRISTUS employees can receive downpayment assistance, save money through a special interest rate and low downpayment, and work with a dedicated housing navigator to find a home that will fit their lifestyle and budget.

Matched Savings ProgramA healthy savings goes a long way toward creating financial wellbeing. We encourage CHRISTUS employees to save more by providing up to $500 in matched savings rewards. The more they save, the more they are rewarded, helping to boost their balance, build a more robust savings, and develop a strong savings habit.

Want to learn more about creating a business partnership with Homewise? Contact Ken Brown, Outreach Manager, at 505.795.7581, or kbrown@homewise.org

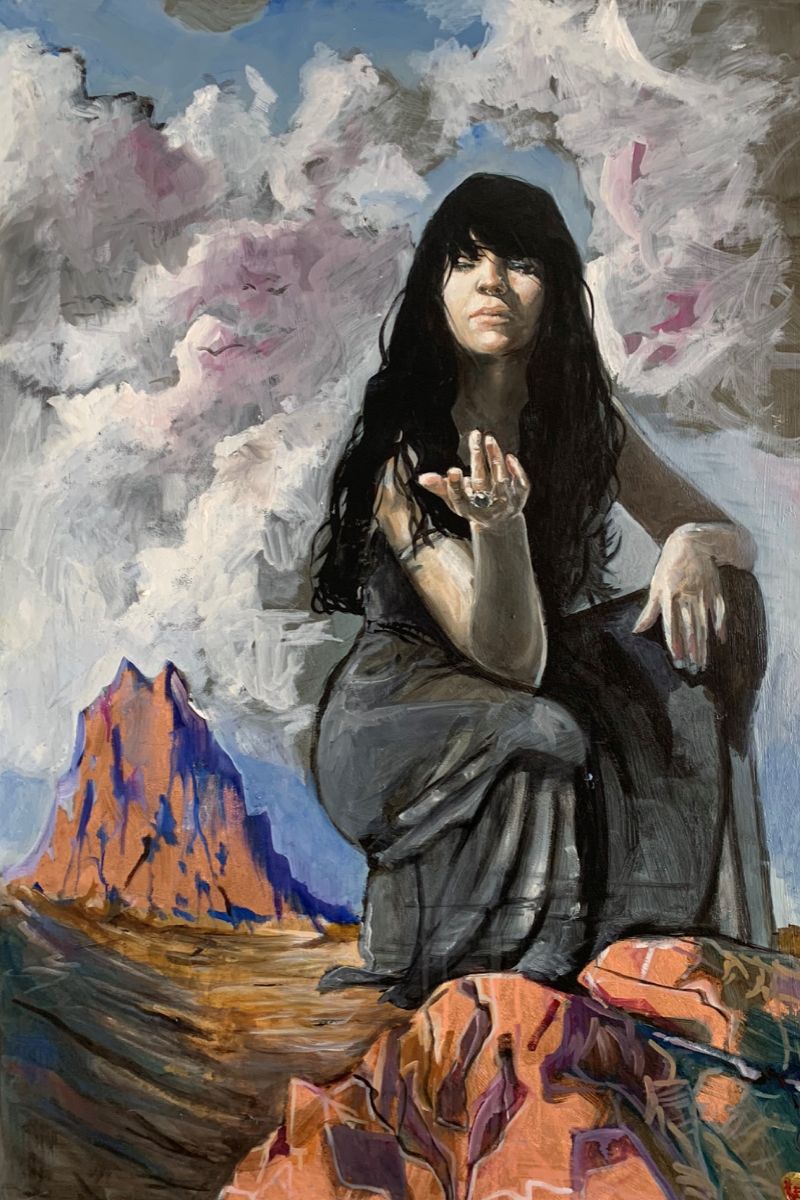

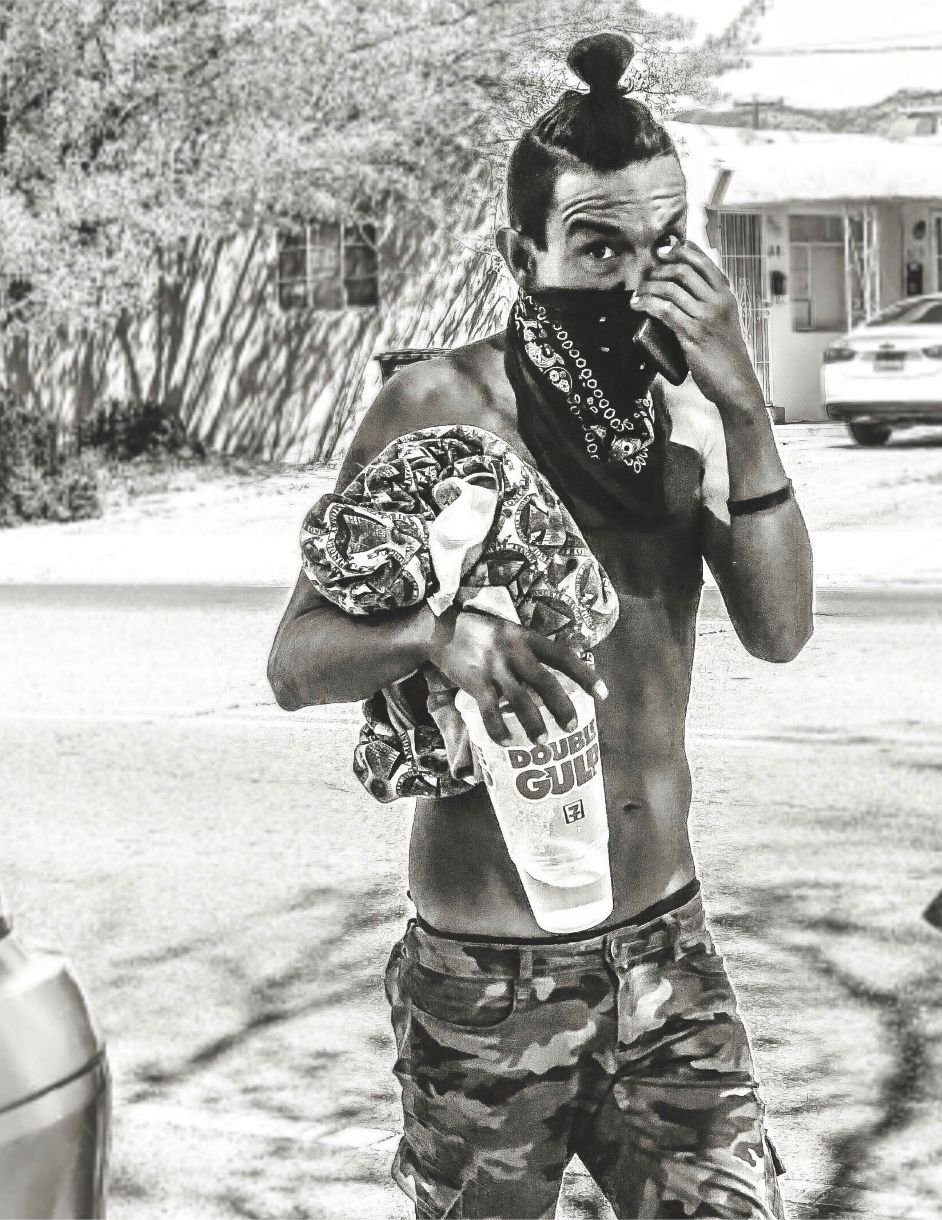

supporting arts & culture in Barelas

In August of 2019, Homewise resumed First Friday events at the Orpheum Community Hub after a hiatus during the renovation of the building. Our inaugural First Friday began with a Barelas photography exhibit presented by the Barelas Neighborhood Association and the Barelas Community Coalition. Other events included Cultura - Photography by Bobby Gutierrez (photo above) and Jotería Undocumented: Tierra, Identidad, Y Transformacion, a collection of work by non-binary artist Gaby Hernandez. see more art

Homewise expanded First Fridays to include events at the Ruppe and has collaborated with ABQ Artwalk/Secret Gallery to curate and host art events at the iconic space.

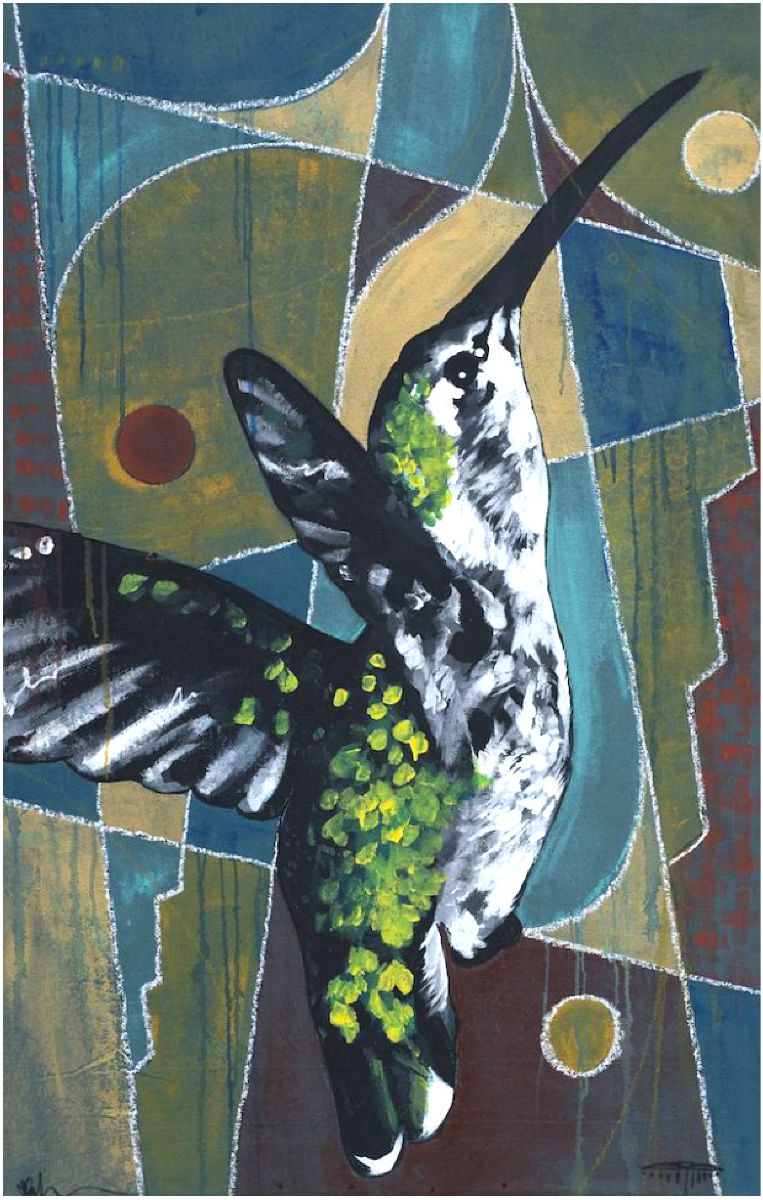

The Bird’s Eye - a painting collaboration between local artists Cloudface and George Evans (artwork above) see more art

Altar - a Dia de los Muertos celebration featuring custom artist ofrendas, local art, and music watch video

In May 2020, Social Distance, a public photography installation, premiered at the Ruppe in partnership with Secret Gallery and IGers (Instagrammers) ABQ. The installation highlighted New Mexico perspectives of the COVID-19 pandemic, highlighting societal adaptations, experiences of isolation, and self-preservation. The installation remained on display in the windows of the Ruppe for two months and is still available to view as a virtual gallery

rethinking

redevelopment

Over the last year, as we’ve grown to understand the critical role of placemaking in our work, we’ve honed our approach to Community Development at Homewise. Placemaking engages residents in the process of collectively reimagining and reinventing spaces in the heart of their community. In Barelas, where our Albuquerque community development efforts are focused, we have now acquired four commercial buildings: the Orpheum, a former grocery at Second Street and Hazeldine, the Ruppe Drugstore and an experimental arts building on the south end of Fourth Street. Each of these buildings has a rich history that we want to carry forward as we redevelop the space for new uses.

We’ve been writing about our approach to the redevelopment of the Ruppe in Shelterforce, a long-standing publication that publishes articles about the field of community development written by practitioners across the country. One of our big lessons has been how important an iterative and flexible approach to redevelopment is when reactivating empty commercial buildings. We encourage you to read more about how we are foregrounding cultural preservation in our approach to redevelopment here.

rethinking

redevelopment

It’s time for developers and preservationists to do more than preserve buildings; we must also work to maintain the cultural identity of the places we are redeveloping.

- Johanna Gilligan

Senior Director, Community Development

Over the last year, as we’ve grown to understand the critical role of placemaking in our work, we’ve honed our approach to Community Development at Homewise. Placemaking engages residents in the process of collectively reimagining and reinventing spaces in the heart of their community. In Barelas, where our Albuquerque community development efforts are focused, we have now acquired four commercial buildings: the Orpheum , a former grocery at Second Street and Hazeldine, the Ruppe Drugstore and an experimental arts building on the south end of Fourth Street. Each of these buildings has a rich history that we want to carry forward as we redevelop the space for new uses.

We’ve been writing about our approach to the redevelopment of the Ruppe in Shelterforce, a long-standing publication that publishes articles about the field of community development written by practitioners across the country.

One of our big lessons has been how important an iterative and flexible approach to redevelop- ment is when reactivating empty commercial buildings. We encourage you to read more about how we are foregrounding cultural preservation in our approach to redevelopment here.

It’s time for developers and preservationists to do more than preserve buildings; we must also work to maintain the cultural identity of the places we are redeveloping.

- Johanna Gilligan

Senior Director, Community Development

Over the last year, as we’ve grown to understand the critical role of placemaking in our work, we’ve honed our approach to Community Development at Homewise. Placemaking engages residents in the process of collectively reimagining and reinventing spaces in the heart of their community. In Barelas, where our Albuquerque community development efforts are focused, we have now acquired four commercial buildings: the Orpheum , a former grocery at Second Street and Hazeldine, the Ruppe Drugstore and an experimental arts building on the south end of Fourth Street. Each of these buildings has a rich history that we want to carry forward as we redevelop the space for new uses.

One of our big lessons has been how important an iterative and flexible approach to redevelop- ment is when reactivating empty commercial buildings. We encourage you to read more about how we are foregrounding cultural preservation in our approach to redevelopment here.

We’ve been writing about our approach to the redevelopment of the Ruppe in Shelterforce, a long-standing publication that publishes articles about the field of community development written by practitioners across the country.

in the spirit of giving

we gratefully acknowledge the active endorsement of our mission by our investors and contributors:

- Financial Institutions

- Ally Bank

- Bank of Albuquerque

- Bank of America

- Bank of the West

- BBVA

- Century Bank

- Enterprise Bank & Trust

- First National 1870

- Kirtland Federal Credit Union

- New Mexico Bank & Trust

- Self-Help Credit Union

- Southwest Capital Bank

- Texas Capital Bank

- UBS Bank

- United Business Bank

- U.S. Bank

- WaFd Bank

- Wells Fargo

- Foundations

- Albuquerque Community Foundation

- Anchorum St. Vincent

- Calvert Impact Capital

- Frost Foundation

- Kalliopeia Foundation

- Los Alamos National Laboratory Foundation

- McCune Charitable Foundation

- Jessie Smith Noyes Foundation

- Onota Foundation

- Erich and Hannah Sachs Foundation

- Santa Fe Community Foundation

- Wells Fargo Housing Foundation

- Community Businesses, Government Agencies and Nonprofits

- Barelas Community Coalition

- CHRISTUS Health

- CHRISTUS St. Vincent Regional Medical Center

- City of Albuquerque

- City of Santa Fe

- CDFI Fund, US Treasury

- Engage Albuquerque

- Housing Partnership Network

- HUB International & Central Insurance

- National Association for Latino Community Asset Builders

- NeighborWorks America

- NeighborWorks Capital

- New Mexico Mortgage Finance Authority

- Opportunity Finance Network

- Prosperity Now

- Prosperity Works

- Sandia National Laboratories

no one has ever become poor from giving.

- Anne Frank- Religious Institutions

- Mercy Investment Services

- Religious Communities Impact Fund

- Seton Enablement Fund

- Sisters of Charity of the Incarnate Word

- Individuals and Investment Funds

- Ann Alexander and Richard Khanlian

- Anonymous

- Avalon Trust

- Avalon Trust clients

- Joel Frederick Barber

- Anne Beckett

- Beth Beloff and Marc Geller

- Erika and Glenn Campos

- Lawrence Carreon

- Jill and Paul Cook

- Quarrier and Phillip Cook

- Susan and Conrad De Jong Fund

- Lori and David Delgado

- Anne Messbarger-Eguia

- Cliff Feigenbaum

- Fresh Pond Capital clients

- Gwen Gilligan

- Elena Gonzales

- Edward Grasskamp

- John Guffey

- Naomi and Robb Hirsch

- Michael Kelly

- Sally Kuhn

- Teresa Leger de Fernandez

- Nahum Ward-Lev

- Ann Lockhart

- Michael Loftin

- Viola Lujan

- Genevieve and A. Paul Mitchell

- Felicia and Daniel Morrow

- Julie Moss

- Mariel Nanasi and Jeffrey Haas

- Kay Naranjo

- Agnes Noonan

- Laura M. Orchard

- Karen E. Orso

- Lynne and Joseph Ptacek

- Stacy S. Quinn

- Celia D. Rumsey Charitable Trust

- Miriam Sagan

- Gail Saunders

- Tom Saunders

- Wilson Scanlan

- Elizabeth and Richard Schnieders

- Nan Schwanfelder

- Martha and Patterson Simons

- Lidia and Daniel Slavin

- Linda and Andrew Spingler

- The Sustainability Group clients

- Alexis Tappan

- Trillium Asset Management clients

- Kathy Ulibarri

- Paul Vogel

- Debra A. Walsh

in the spirit of giving

we gratefully acknowledge the active endorsement of our mission by our investors and contributors:

- Financial Institutions

- Ally Bank

- Bank of Albuquerque

- Bank of America

- Bank of the West

- BBVA

- Century Bank

- Enterprise Bank & Trust

- First National 1870

- Kirtland Federal Credit Union

- New Mexico Bank & Trust

- Self-Help Credit Union

- Southwest Capital Bank

- Texas Capital Bank

- UBS Bank

- United Business Bank

- U.S. Bank

- WaFd Bank

- Wells Fargo

- Foundations

- Albuquerque Community Foundation

- Anchorum St. Vincent

- Calvert Impact Capital

- Frost Foundation

- Kalliopeia Foundation

- Los Alamos National Laboratory Foundation

- McCune Charitable Foundation

- Jessie Smith Noyes Foundation

- Onota Foundation

- Erich and Hannah Sachs Foundation

- Santa Fe Community Foundation

- Wells Fargo Housing Foundation

no one has ever become poor from giving.

- Anne Frank- Community Businesses, Government Agencies and Nonprofits

- Barelas Community Coalition

- CHRISTUS Health

- CHRISTUS St. Vincent Regional Medical Center

- City of Albuquerque

- City of Santa Fe

- CDFI Fund, US Treasury

- Engage Albuquerque

- Housing Partnership Network

- HUB International & Central Insurance

- National Association for Latino Community Asset Builders

- NeighborWorks America

- NeighborWorks Capital

- New Mexico Mortgage Finance Authority

- Opportunity Finance Network

- Prosperity Now

- Prosperity Works

- Sandia National Laboratories

- Religious Institutions

- Mercy Investment Services

- Religious Communities Impact Fund

- Seton Enablement Fund

- Sisters of Charity of the Incarnate Word

- Individuals and Investment Funds

- Ann Alexander and Richard Khanlian

- Anonymous

- Avalon Trust

- Avalon Trust clients

- Joel Frederick Barber

- Anne Beckett

- Beth Beloff and Marc Geller

- Erika and Glenn Campos

- Lawrence Carreon

- Jill and Paul Cook

- Quarrier and Phillip Cook

- Susan and Conrad De Jong Fund

- Lori and David Delgado

- Anne Messbarger-Eguia

- Cliff Feigenbaum

- Fresh Pond Capital clients

- Gwen Gilligan

- Elena Gonzales

- Edward Grasskamp

- John Guffey

- Naomi and Robb Hirsch

- Michael Kelly

- Sally Kuhn

- Teresa Leger de Fernandez

- Nahum Ward-Lev

- Ann Lockhart

- Michael Loftin

- Viola Lujan

- Genevieve and A. Paul Mitchell

- Felicia and Daniel Morrow

- Julie Moss

- Mariel Nanasi and Jeffrey Haas

- Kay Naranjo

- Agnes Noonan

- Laura M. Orchard

- Karen E. Orso

- Lynne and Joseph Ptacek

- Stacy S. Quinn

- Celia D. Rumsey Charitable Trust

- Miriam Sagan

- Gail Saunders

- Tom Saunders

- Wilson Scanlan

- Elizabeth and Richard Schnieders

- Nan Schwanfelder

- Martha and Patterson Simons

- Lidia and Daniel Slavin

- Linda and Andrew Spingler

- The Sustainability Group clients

- Alexis Tappan

- Trillium Asset Management clients

- Kathy Ulibarri

- Paul Vogel

- Debra A. Walsh

in the

spirit of

giving

we gratefully acknowledge the active endorsement of our mission by our investors and contributors:

- Financial Institutions

- Ally Bank

- Bank of Albuquerque

- Bank of America

- Bank of the West

- BBVA

- Century Bank

- Enterprise Bank & Trust

- First National 1870

- Kirtland Federal Credit Union

- New Mexico Bank & Trust

- Self-Help Credit Union

- Southwest Capital Bank

- Texas Capital Bank

- UBS Bank

- United Business Bank

- U.S. Bank

- WaFd Bank

- Wells Fargo

- Foundations

- Albuquerque Community Foundation

- Anchorum St. Vincent

- Calvert Impact Capital

- Frost Foundation

- Kalliopeia Foundation

- Los Alamos National Laboratory Foundation

- McCune Charitable Foundation

- Jessie Smith Noyes Foundation

- Onota Foundation

- Erich and Hannah Sachs Foundation

- Santa Fe Community Foundation

- Wells Fargo Housing Foundation

- Community Businesses, Government Agencies and Nonprofits

- Barelas Community Coalition

- CHRISTUS Health

- CHRISTUS St. Vincent Regional Medical Center

- City of Albuquerque

- City of Santa Fe

- CDFI Fund, US Treasury

- Engage Albuquerque

- Housing Partnership Network

- HUB International & Central Insurance

- National Association for Latino Community Asset Builders

- NeighborWorks America

- NeighborWorks Capital

- New Mexico Mortgage Finance Authority

- Opportunity Finance Network

- Prosperity Now

- Prosperity Works

- Sandia National Laboratories

no one has ever become poor from giving.

- Anne Frank- Religious Institutions

- Mercy Investment Services

- Religious Communities Impact Fund

- Seton Enablement Fund

- Sisters of Charity of the Incarnate Word

- Individuals and Investment Funds

- Ann Alexander and Richard Khanlian

- Anonymous

- Avalon Trust

- Avalon Trust clients

- Joel Frederick Barber

- Anne Beckett

- Beth Beloff and Marc Geller

- Erika and Glenn Campos

- Lawrence Carreon

- Jill and Paul Cook

- Quarrier and Phillip Cook

- Susan and Conrad De Jong Fund

- Lori and David Delgado

- Anne Messbarger-Eguia

- Cliff Feigenbaum

- Fresh Pond Capital clients

- Gwen Gilligan

- Elena Gonzales

- Edward Grasskamp

- John Guffey

- Naomi and Robb Hirsch

- Michael Kelly

- Sally Kuhn

- Teresa Leger de Fernandez

- Nahum Ward-Lev

- Ann Lockhart

- Michael Loftin

- Viola Lujan

- Genevieve and A. Paul Mitchell

- Felicia and Daniel Morrow

- Julie Moss

- Mariel Nanasi and Jeffrey Haas

- Kay Naranjo

- Agnes Noonan

- Laura M. Orchard

- Karen E. Orso

- Lynne and Joseph Ptacek

- Stacy S. Quinn

- Celia D. Rumsey Charitable Trust

- Miriam Sagan

- Gail Saunders

- Tom Saunders

- Wilson Scanlan

- Elizabeth and Richard Schnieders

- Nan Schwanfelder

- Martha and Patterson Simons

- Lidia and Daniel Slavin

- Linda and Andrew Spingler

- The Sustainability Group clients

- Alexis Tappan

- Trillium Asset Management clients

- Kathy Ulibarri

- Paul Vogel

- Debra A. Walsh

ensuring New Mexico’s most financially vulnerable residents can keep their homes

Homewise is providing emergency mortgage assistance to those most financially vulnerable in the COVID-19 crisis to ensure they can continue to make their mortgage payments and keep their homes. This assistance is especially critical for those left out of the current federal safety net and those who have lost the majority or all of their household income due to COVID-19 related economic conditions.

Those most at risk include low-income people who are not included in the current federal safety net because they are self-employed or work non-traditional jobs that will not allow them to access unemployment insurance. Immigrants who do not have access to federal assistance programs are also especially financially vulnerable right now.

Housing costs are most households’ biggest monthly expense. Currently there is no federal program available to help those low-income homeowners who do not qualify for unemployment benefits or stimulus checks. Right now, the only clear option for homeowners is a temporary forbearance of monthly payments. This allows borrowers to suspend monthly mortgage payments for up to 12 months. However, most homeowners must pay that money back through a repayment plan on top of their regular payment. This option does not meet the needs of the most financially vulnerable homeowners who are unlikely to be able to pay a significantly increased monthly mortgage while trying to recover from low or no employment.

Losing your home to foreclosure is a traumatic process that, in the worst-case scenario, can increase the number of homeless people in our community, putting further strain on limited social services. Foreclosures also have negative impacts on neighborhoods when homes remain vacant, possibly becoming problem properties that create public safety issues. The social and economic consequences of foreclosure can and must be avoided by proactively helping low-income homeowners now.

How can you Help?

Invest in the Homewise Community Investment Fund

With an investment in the Homewise Community Investment Fund, you can directly impact the financial security of low-income families in our community while also earning a financial return on your investment. With a minimum investment of $1,000, the Fund offers interest rate returns between 1- 4% and investment terms of 1 to 15 years.

Your investment helps advance meaningful public policy and funding changes to support low-income families in achieving and maintaining financial stability through successful homeownership. Demonstrating growth in the Fund is also a powerful point in attracting new funding from institutional investors like foundations, corporations, and government entities.

Together we can make a critical difference in keeping our most at-risk homeowners in their homes during these challenging times, making our future economic recovery that much faster and stronger! We appreciate your continued partnership – your support can help the most financially vulnerable in our community weather this storm.

Learn more about how you can make a difference through the Homewise Community Investment Fund

You can also send us an email: invest@homewise.org

ensuring New Mexico’s most financially vulnerable residents can keep their homes

Homewise is providing emergency mortgage assistance to those most financially vulnerable in the COVID-19 crisis to ensure they can continue to make their mortgage payments and keep their homes. This assistance is especially critical for those left out of the current federal safety net and those who have lost the majority or all of their household income due to COVID-19 related economic conditions.

Those most at risk include low-income people who are not included in the current federal safety net because they are self-employed or work non-traditional jobs that will not allow them to access unemployment insurance. Immigrants who do not have access to federal assistance programs are also especially financially vulnerable right now.

Housing costs are most households’ biggest monthly expense. Currently there is no federal program available to help those low-income homeowners who do not qualify for unemployment benefits or stimulus checks. Right now, the only clear option for homeowners is a temporary forbearance of monthly payments. This allows borrowers to suspend monthly mortgage payments for up to 12 months. However, most homeowners must pay that money back through a repayment plan on top of their regular payment. This option does not meet the needs of the most financially vulnerable homeowners who are unlikely to be able to pay a significantly increased monthly mortgage while trying to recover from low or no employment.

Losing your home to foreclosure is a traumatic process that, in the worst-case scenario, can increase the number of homeless people in our community, putting further strain on limited social services. Foreclosures also have negative impacts on neighborhoods when homes remain vacant, possibly becoming problem properties that create public safety issues. The social and economic consequences of foreclosure can and must be avoided by proactively helping low-income homeowners now.

How can you Help?

Invest in the Homewise Community Investment Fund

With an investment in the Homewise Community Investment Fund, you can directly impact the financial security of low-income families in our community while also earning a financial return on your investment. With a minimum investment of $1,000, the Fund offers interest rate returns between 1- 4% and investment terms of 1 to 15 years.

Your investment helps advance meaningful public policy and funding changes to support low-income families in achieving and maintaining financial stability through successful homeownership. Demonstrating growth in the Fund is also a powerful point in attracting new funding from institutional investors like foundations, corporations, and government entities.

Together we can make a critical difference in keeping our most at-risk homeowners in their homes during these challenging times, making our future economic recovery that much faster and stronger! We appreciate your continued partnership – your support can help the most financially vulnerable in our community weather this storm.

Learn more about how you can make a difference through the Homewise Community Investment Fund

You can also send us an email: invest@homewise.org

Housing costs are most households’ biggest monthly expense. Currently there is no federal program available to help those low-income homeowners who do not qualify for unemployment benefits or stimulus checks. Right now, the only clear option for homeowners is a temporary forbearance of monthly payments. This allows borrowers to suspend monthly mortgage payments for up to 12 months.

However, most homeowners must pay that money back through a repayment plan on top of their regular payment. This option does not meet the needs of the most financially vulnerable homeowners who are unlikely to be able to pay a significantly increased monthly mortgage while trying to recover from low or no employment.

Losing your home to foreclosure is a traumatic process that, in the worst-case scenario, can increase the number of homeless people in our community, putting further strain on limited social services. Foreclosures also have negative impacts on neighborhoods when homes remain vacant, possibly becoming problem properties that create public safety issues. The social and economic consequences of foreclosure can and must be avoided by proactively helping low-income homeowners now.

How can you Help?

Invest in the Homewise Community Investment Fund

With an investment in the Homewise Community Investment Fund, you can directly impact the financial security of low-income families in our community while also earning a financial return on your investment. With a minimum investment of $1,000, the Fund offers interest rate returns between 1- 4% and investment terms of 1 to 15 years.

Your investment helps advance meaningful public policy and funding changes to support low-income families in achieving and maintaining financial stability through successful homeownership. Demonstrating growth in the Fund is also a powerful point in attracting new funding from institutional investors like foundations, corporations, and government entities.

Together we can make a critical difference in keeping our most at-risk homeowners in their homes during these challenging times, making our future economic recovery that much faster and stronger! We appreciate your continued partnership – your support can help the most financially vulnerable in our community weather this storm.

Learn more about how you can make a difference through the Homewise Community Investment Fund

You can also send us an email: invest@homewise.org

our

leadership

team

our board

of directors

Santa Fe Homeownership Center

505.983.9473 1301 Siler Rd, Bldg D

Albuquerque Homeownership Center

and Orpheum Community Hub

505.243.6566 500 2nd St SW ABQ

our leadership team

Homeowner Patricia (2nd from left) with her Homewise Team: Home Purchase Advisor Sandy, Mortgage Loan Officer Cristina, and Realtor® Alexis

Homeowner Patricia (2nd from left) with her Homewise Team: Home Purchase Advisor Sandy, Mortgage Loan Officer Cristina, and Realtor® Alexis

our board of directors

our

leadership

team

our board

of directors